It is important as a nursery owner or employee to know National Minimum Wage (NMW) rates.

What is the National Minimum Wage in nurseries?

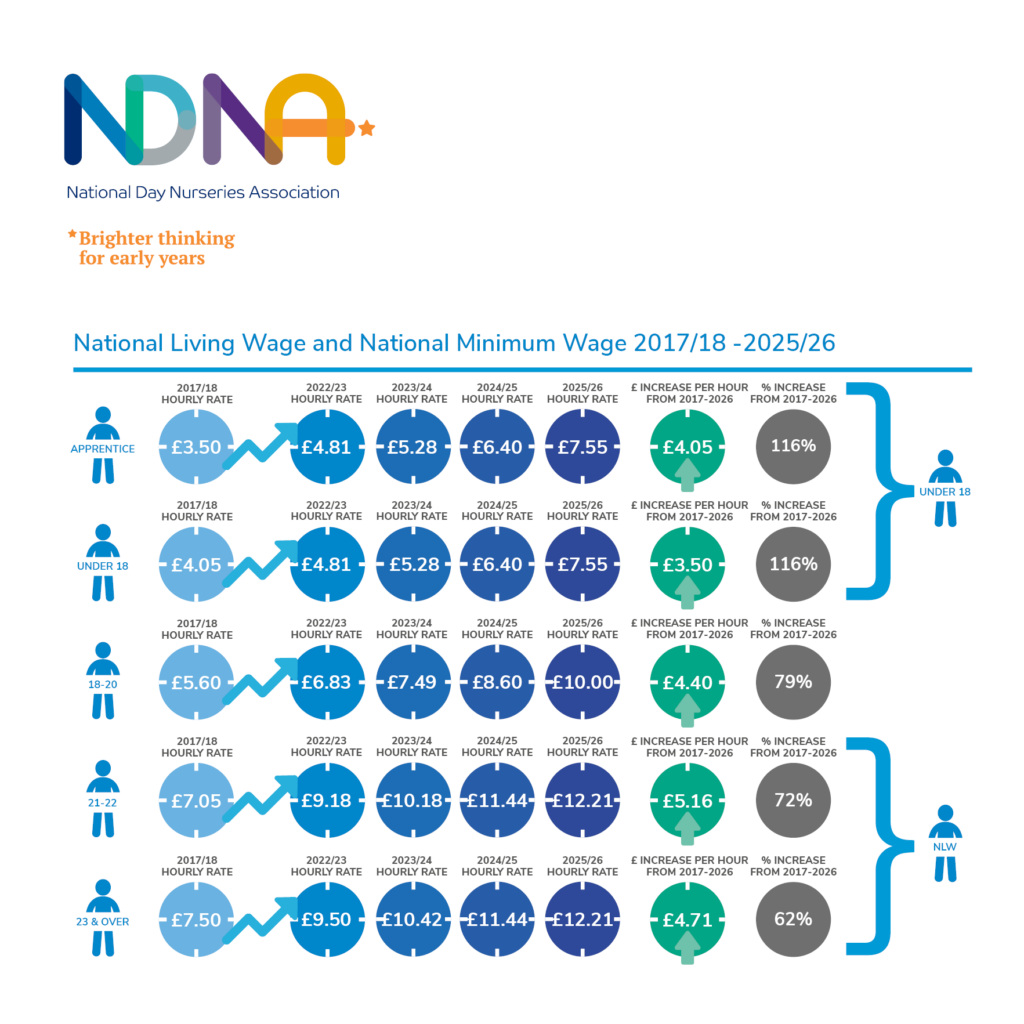

NMW is the minimum pay per hour almost all workers in your nursery are entitled to. The National Living Wage is different. It is higher than the National Minimum Wage – workers get it if they’re 21 or over. See government guidance on the National Minimum Wage and National Living Wage for nurseries here.

The National Minimum Wage is paid at a number of different rates:

New rates for 2025/26

The National Living Wage and National Minimum Wage will rise from April 2025. Read more here.

National Minimum Wage rates for nursery apprentices

Whether or not someone is actually an apprentice is a matter of fact. An apprentice has to be taking part in a recognised apprenticeship and not just someone who’s called an ‘apprentice’. This means that, if you engage a 16-year old in August with a view to them commencing an official apprenticeship in September, as they are not an apprentice until September, paying them the apprentice rate in August would not satisfy the NMW rules.

The NMW does not have to be paid for every hour worked, but it has to be paid on average over the pay reference period.

What counts as ‘Pay’?

There are two elements that make up the ‘rate of pay’ for NMW purposes – pay that counts in the pay reference period and hours that count in the pay reference period. The pay that counts divided by the hours that count gives the average hourly rate of pay.